We make AI for CX Quiq

Engineered for enterprise-sized business outcomes

AI can make your CX more efficient.

But Quiq will change your business.

Quiq’s Conversational CX Platform is powered by Generative AI and Large Language Models (just like ChatGPT) to help you serve your customers better and take performance to a whole new level – and to do it accurately and safely (unlike ChatGPT).

Accelerate with AI

Harness the power of the latest AI technology to revolutionize your CX in an environment that makes your people and data more efficient than ever.

Trust and safety comes first

Quiq respects your data so that it will never be used to train a commercial LLM. Our use of AI is grounded, fact checked and safeguarded to minimize the possibility of hallucinations and brand embarrassments.

Surpass customer expectations

Create the rich experiences that consumers prefer on the messaging channels they use with family and friends. Quiq raises metrics your business cares about—like NPS and CSAT—with AI-powered asynchronous business messaging.

Get started with a demo.

Scaled and scoped to deliver

enterprise-grade CX — here’s how.

Don’t just build stronger customer relationships. Do it at scale, with AI that’s scoped

for trust and safety at enterprise scale.

Resolve more inquiries faster with AI assistants built with Generative AI.

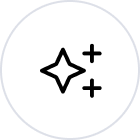

Customer AI Assistants

By leveraging Generative AI combined with your company knowledge and data, customers get concise, accurate and personalized answers created directly from your data — as if they had a human agent helping them.

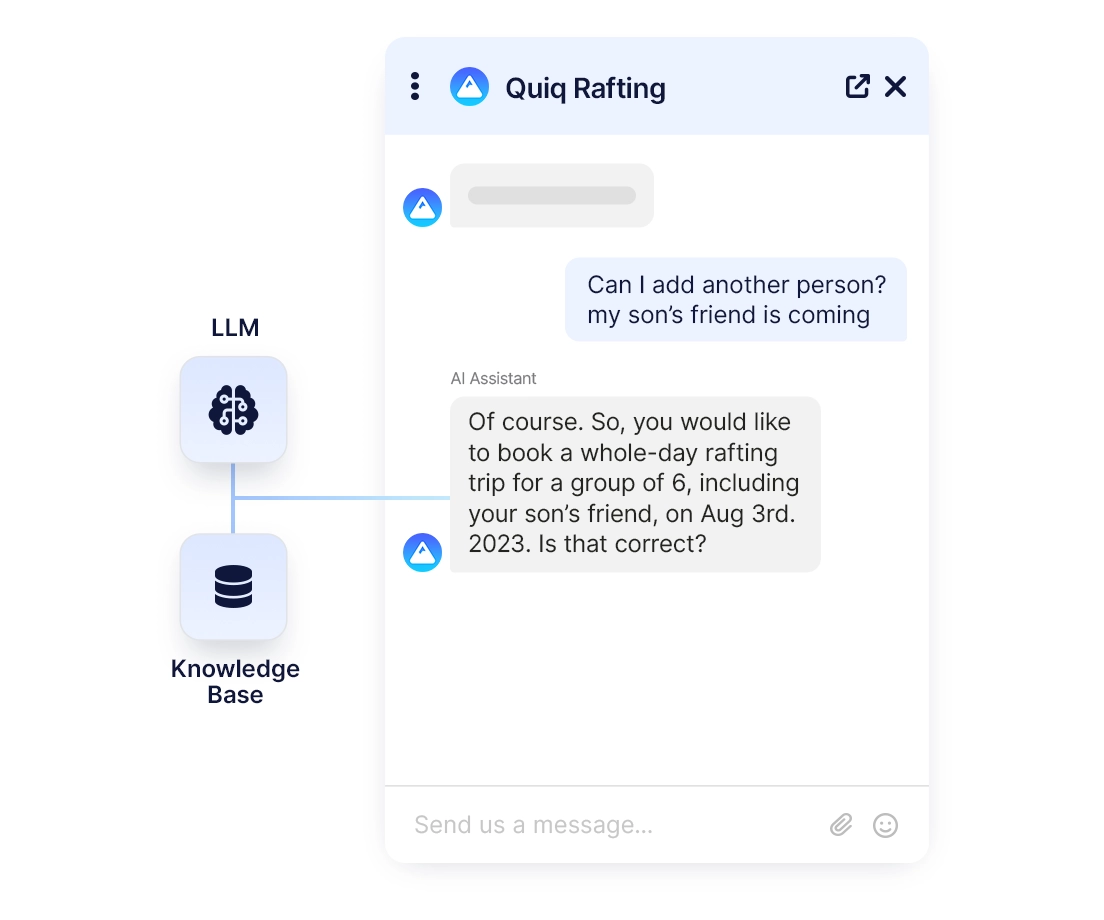

Agent AI Assistants

Not every question can be answered by AI, so Quiq’s AI-assisted contact center empowers human agents to handle many simultaneous asynchronous conversations across all popular messaging channels.

Deliver business value faster by building with AI Studio.

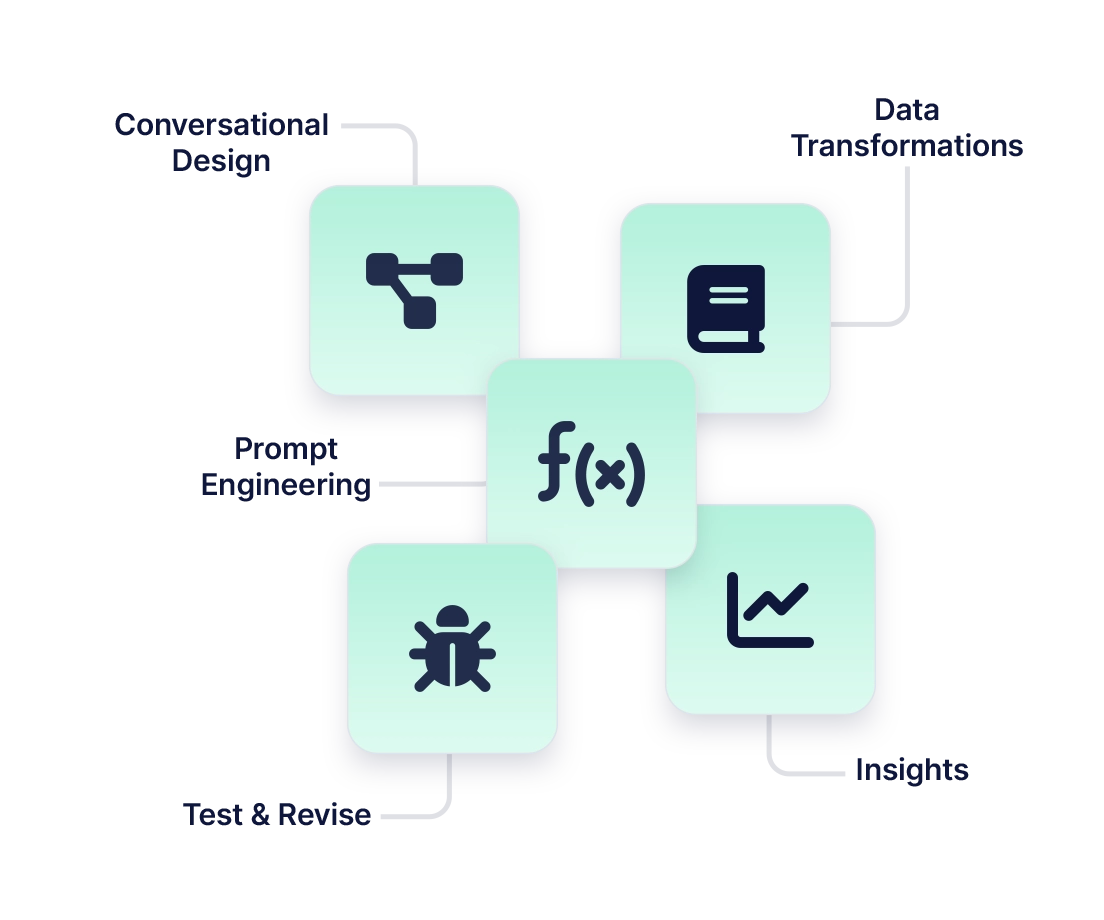

A powerful set of AI tools built specifically for CX

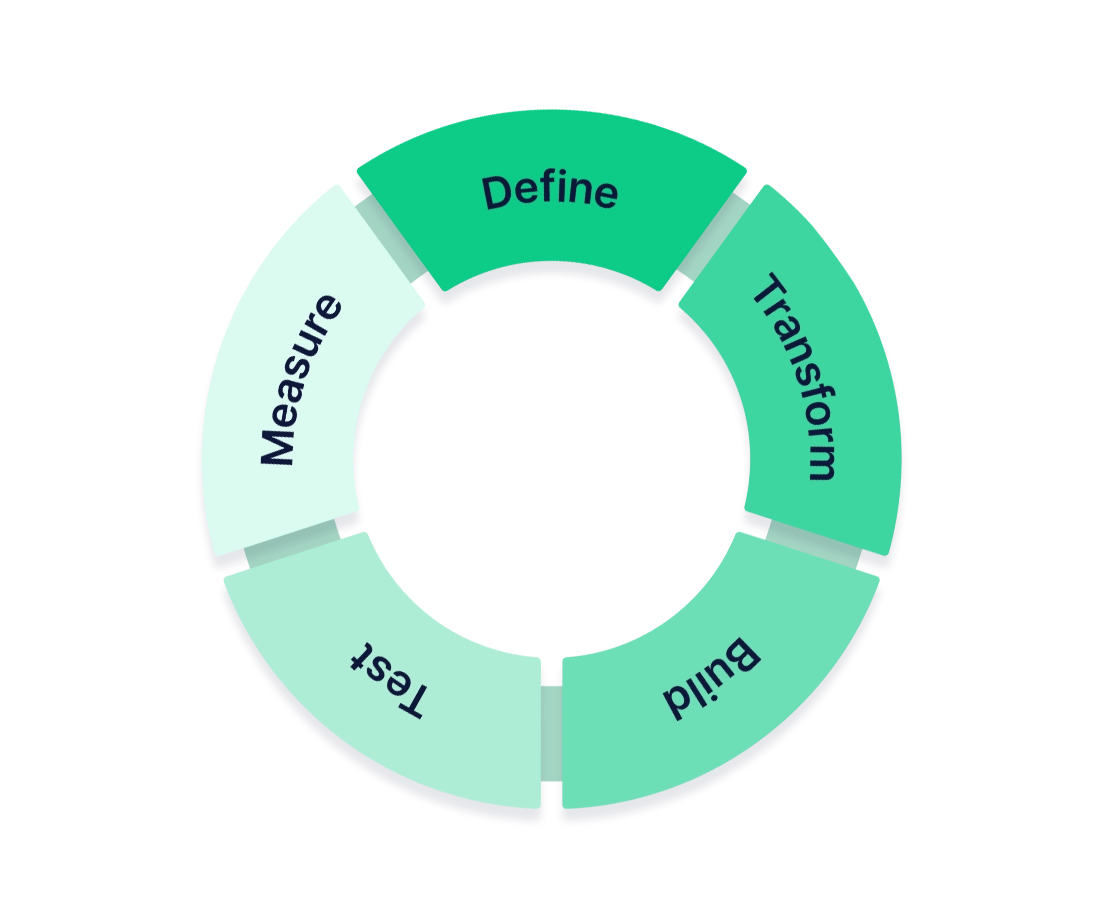

AI Studio is an enterprise-grade development environment for building, testing, deploying and measuring AI for CX.

All stages of AI development seamlessly together

Conversational CX strategy & design, coding, and performance measurement – it can all be overwhelming. AI Studio brings it all together, enabling your team to build faster.

Craft rewarding CX with naturally-asynchronous interactions.

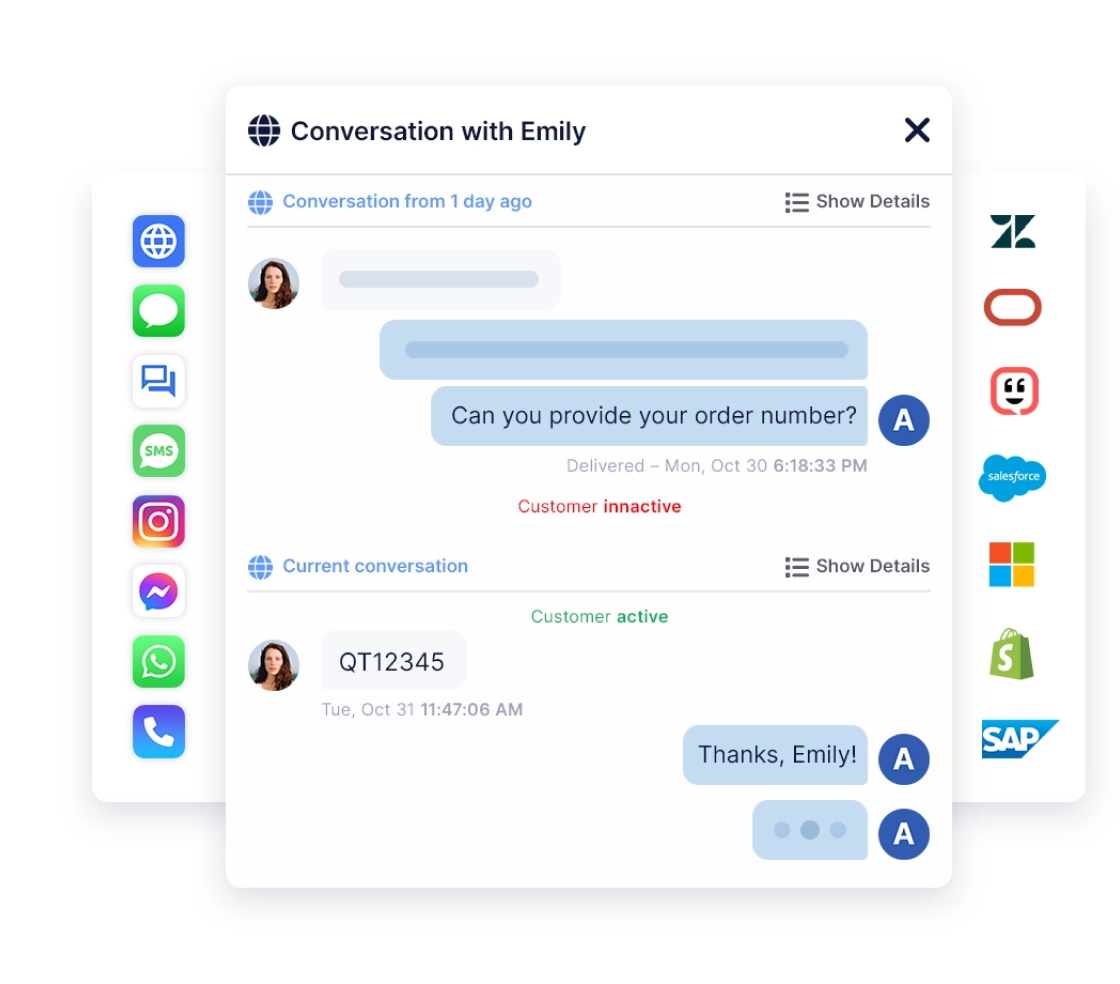

Recognize customer preference for digital messaging.

Digital channels like messaging are preferred by customers over other communication channels like phone and email. They offer convenience, reach—and a rich canvas for you to deliver memorable, brand-building customer experiences.

Manage asynchronous conversations more effectively.

Quiq helps your team manage multiple conversations that may be active at different times, as well as reporting and insights to help organizational leaders oversee and improve CX operations.

Upgrade your CRM to async.

Accelerate your time to value by seamlessly integrating Quiq with your CRM.

Trust a solution that’s enterprise-architected.

Scalability and performance - built for enterprises

Quiq was built to handle the capacity and performance needs of large enterprises with millions of customers.

AI that’s both powerful and secure

Quiq understands the importance of your data. Our systems and processes are designed to ensure that AI is used safe and securely.

Don’t just take our word for it.

Hear from our customers and read their stories.